It's one of the difficult questions for us as independent insurance agents to talk about: Do you have life insurance for your kids?

Why is it difficult? On its surface, the notion is disturbing and a little morbid. Life insurance first and foremost is about providing a death benefit. And who wants to consider the consequences of the death of your child.

And then there are pragmatic considerations. Very few children, relatively speaking, die in the U.S. and no one depends upon them for financial support.

Yet, there are other important aspects of children's life insurance for parents to consider. And they aren't about death as much as helping your child with his or her future. And what parent doesn't want to do that.

My wife and I have policies for both of our boys because we truly believe it's something our kids should have for their futures. And I'm not just saying that because I'm an insurance broker -- my job is to make sure you and your families are protected.

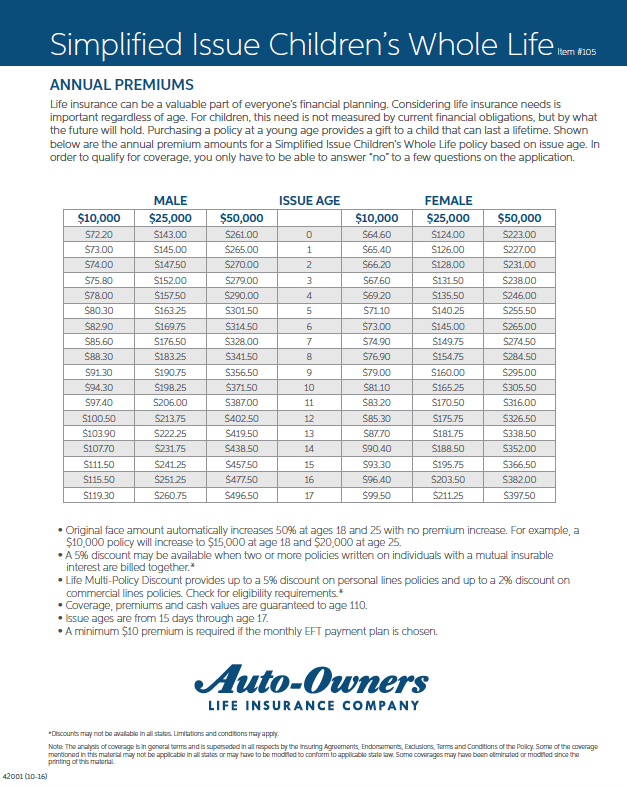

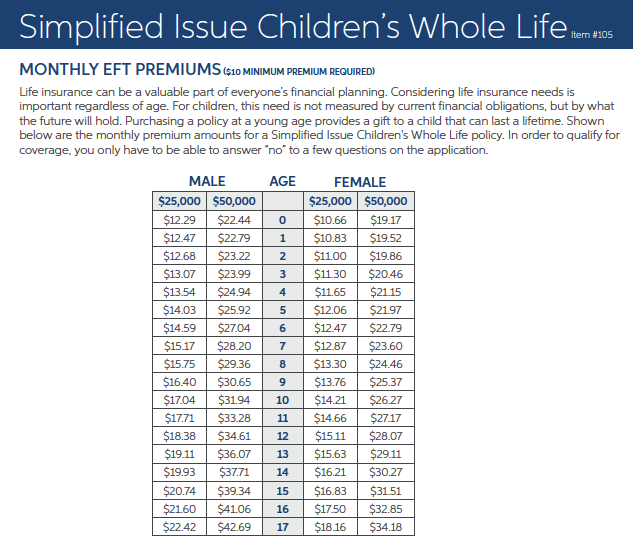

Let's look at a product from Auto-Owners called Simplified Whole Children's Life Insurance as an example.

Future Insurability

Purchasing life insurance for a child in their early years helps protect their insurability in the future.

What does this really mean?

If your child experiences significant health issues as he or she ages making life insurance unaffordable, or worse, unattainable, having a policy in place now ensures they will have something to protect them financially.

AND, the policy requirements for children are much less strict that usually required for life insurance application. All you have to do is answer "no" to a few questions and the process is started in ensuring your child's future.

Future Source of Funds

Permanent life insurance policies have the advantage of building cash value, which earns interest at a declared rate and is available to be surrendered from the policy.

In other words, it builds a nest egg.

Your child can cash out the policy for a sum or money or take a loan against the cash value. Obviously, there are charges and policy conditions, but

Future Coverages

The death benefit will automatically increase by 50% of the original death benefit at age 18 and then again at age 25 with NO increase in premium.

For example, if a policy started for a 10-year-old with $50,000 in coverage... at age 18, the death benefit would increase to $75,00 and then to $100,000 at age 25.

Affordability

Children's life insurance typically COSTS LESS than it does for adults. And, the earlier you start a policy, the more affordable it is. Your child can take over the payments between ages 18-25, at your discretion. They will pay the same premium the entire life of the policy - so if you started a $25,000 policy for your daughter at age 9 for $160, she'll take on the payments of $160 annually or pay a little over $13 a month.

Real Life Scenario

We started a policy for our son Cole when he was age 1 for $50,000. That means at 25, he'll have $100,000 of coverage. He'll continue to pay $265 per year EVERY year moving forward after he takes over monthly payments at age 25. When he turns 55, he can cash the policy in and take $34,800 home to his family or he can stop paying the premium and keep a $91,000 death benefit life insurance policy. At 55, the total premiums paid would be $14,575 - not a bad deal if he cashes out at $34,800!

Learn More or Start an Application

Give us a call at 952-854-01019, or easier yet, email your agent, myself or office [at] lakesideins [dot] com to get started. It's a decision you won't regret!